This is part 1 of a 2-part blog. Here we’ll discuss the impact of the IRA on utilities and energy agencies, and some common challenges. In Part 2, we’ll share utility best practices to meet increased DER program demands and demonstrate how Clean Power Research is helping utilities and energy agencies adapt.

The Inflation Reduction Act (IRA) has all but taken over the utility industry news cycle and continues to do so for good reason. A record $369 billion in funding is available for clean energy and climate change related initiatives over the next decade. Models project that the IRA could reduce annual carbon emissions by approximately 1 billion metric tons by 2030, significantly helping to reach the goal of reducing emissions by approximately 50% below 2005 levels.

The IRA is intended to accelerate clean and renewable energy while cutting energy costs for Americans through a broad range of provisions. Many facets of the IRA are expected to provide opportunities for the utility industry to simultaneously support decarbonization goals and customer savings.

So, what does the Inflation Reduction Act mean for utilities and their customers?

As we continue to unpack the massive 730-plus page document and discover how the IRA may affect utilities, energy agencies and their customers, two broad elements particularly worth mentioning are:

- The “certainty” of large-scale renewable projects

- The rapid expansion of energy programs

Let’s start with provisions in the IRA that bring more certainty and stability to large-scale renewable energy projects, such as solar and wind.

Renewable project certainty

The critical role utilities and energy agencies play in reducing greenhouse gas (GHG) emissions is reflected in the IRA’s breadth of provisions for investor-owned utilities (IOUs), public municipal utilities (munis), cooperatives (co-ops) and community choice aggregators (CCAs).

In the past decade, we’ve seen decarbonization efforts expanding rapidly with electric utilities, but tax-exempt munis, co-ops and CCAs have been left out of previous tax credit incentives.

With the IRA, smaller, tax-exempt electricity providers representing millions of customers are eligible to receive direct pay cash grants, helping to level the playing field for public utilities. These grants will help improve access to large-scale renewable energy options and energy programs for customers of tax-exempt electricity providers.

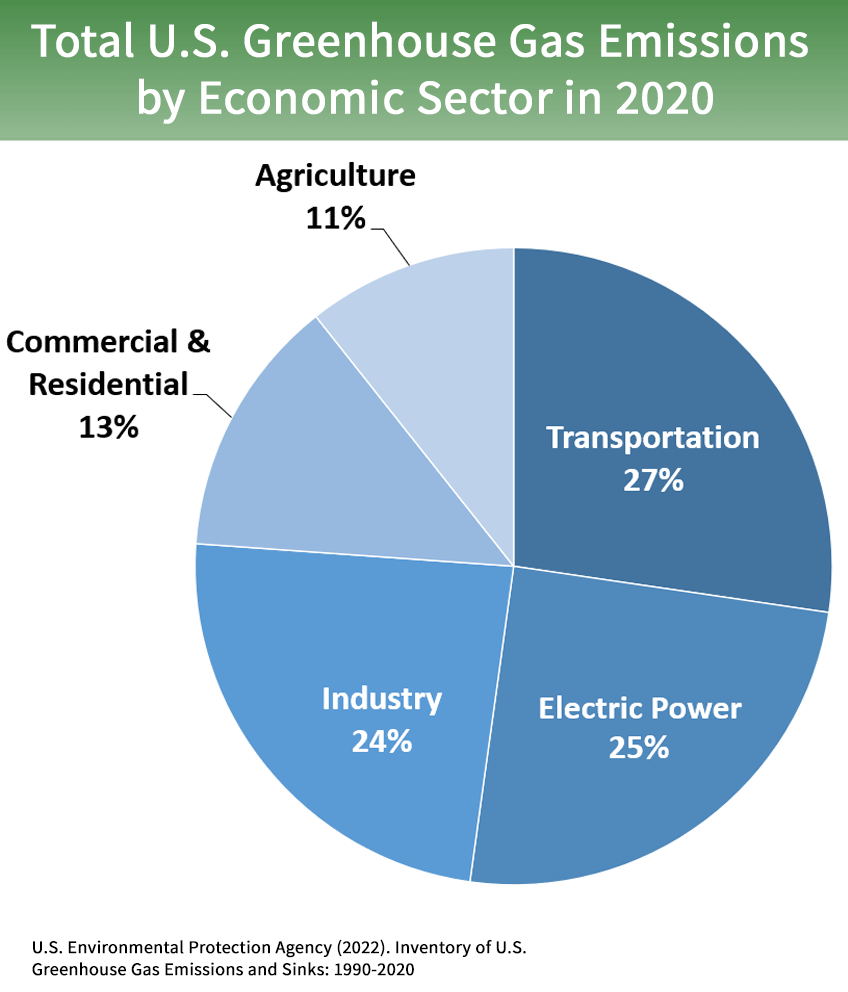

The IRA has numerous provisions to address a variety of GHG causes in the sectors outlined in this EPA chart.

To highlight a lesser-known rural electric co-op win, $9.7 billion in funding is earmarked for renewable energy, storage, carbon capture and zero-emission systems through the Department of Agriculture.

Many customers in the agricultural energy sector—which produce approximately 11% of U.S. emissions—are located within electric co-op territories.

While the coverage for all types of electricity providers is significant, the new level of certainty provided by the IRA will profoundly accelerate the adoption of new renewable power projects across the U.S.

Here are two ways the IRA supports certainty and reliability:

- Many tax credits will continue through 2032. The IRA will provide large-scale renewable project developers with more certainty than previously experienced, reducing the risk for developers to invest in resources necessary to meet utility demand.

- IRA tax credits and reinvestment financing remove barriers to adopting renewable energy. Utilities now have access to tax credits and guaranteed loans to build renewable and carbon-free projects, replacing non-renewable projects to impact GHG emissions.

And here are two other noteworthy provisions supporting the acceleration of renewable energy sources:

- Storage tax credits are now de-coupled from solar projects, allowing for more project flexibility and stand-alone storage to address the intermittency of renewable energy generation.

- The Energy Infrastructure Reinvestment (EIR) Program, a program created by the IRA, is dedicating $5 billion to guarantee loans for qualifying grid modernization projects.

With reliable and ongoing credits and financing in place, utilities and developers can work together to decarbonize electricity grids with fewer hurdles. To significantly reduce carbon emissions, clean electric generation is being accompanied by the rapid deployment of customer electrification and efficiency, which we’ll explore below.

Electrification, DERs and energy efficiency

Renewable energy programs had already gained momentum before the IRA. The additional funding is expected to further accelerate the adoption of new technologies across three core categories:

- Transportation Electrification, including EV rebates, complex commercial charging installations, fleet electrification and more

- Building electrification, including rebates for equipment like heat pumps, heat pump water heaters, induction cooktops and ovens, and more

- Energy Efficiency, including affordable housing efficiency rebates, insulation/sealing rebates, upgraded electrical wiring and more

With billions dedicated to end-use electrification and efficiency programs, utilities big and small will have new opportunities to participate in this massive decarbonization effort.

Challenges with meeting the scale of the Inflation Reduction Act

IRA funding, coupled with increased customer interest in building and transportation electrification and efficiency, is driving rapid energy program growth. Utilities must be able to streamline and scale energy programs to keep up with numerous administrative responsibilities. We see challenges forming within three core areas:

- Customer education and engagement: As utilities scale up energy programs, curious customers will have many, many questions for their utility, such as: “Is solar right for me?” “How does EV home charging work?” “Should I add storage?” “What rate plan is best if I have solar and an EV?”

- Scaling DER and electrification energy programs: While many utilities already administer energy programs for PV and EV, the IRA and consumer interest are expected to significantly increase the types of programs and number of applications utilities manage. Numerous utilities will need to scale programs with a lean program administration team and avoid extended queues. The operations team will also need to accurately model load growth caused by a rise in DER adoption and consider how to document the proliferation and variety of DERs on customer sites.

- More stringent regulatory reporting requirements: Federal and state funding programs tend to be coupled with regulatory reporting requirements, and with the amount of money we’re seeing with the IRA, those requirements are likely to be rigorous. Utilities will need the ability to run reports in-house with little effort or face having to contract out this daunting task and support the contracted effort.

Now that we’ve laid out some of the utility-related IRA provisions and some challenges, next, we’ll share utility best practices to meet increased DER program demands and demonstrate how Clean Power Research is helping utilities and energy agencies adapt to the clean energy transition. To be continued…

To learn more about Clean Power Research utility focused products and solutions, contact us.

More IRA Resources

Click here for Part 2 of the IRA blog

Click here to view a cultivated list of articles covering the IRA as it relates to utilities