Utilities across the U.S. are eager to know how much PV their customers will adopt, as this adoption can impact both revenues (from reduction in energy purchases) and costs (linked to distribution operation and intermittency mitigation). Having seen the explosive growth of PV in a few key states across the US, the majority of utilities are heeding the warning of their peers and preparing for similar adoption in their own territories.

The three central questions that each of these utilities must answer are:

- How much?

- How quickly? and

- Where?

Clean Power Research’s consulting group has worked with a number of utilities and energy organizations to answer these questions. Recently, we wanted to see what we could learn from past adoption data by using a relatively simple adoption model: The Bass Diffusion Model.

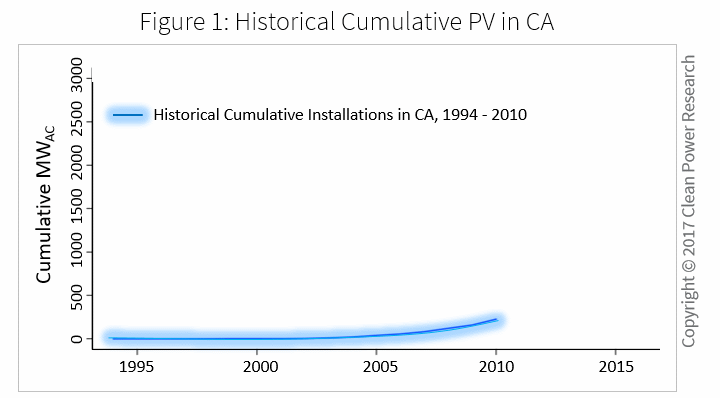

In Figure 1, below, we plot the PV capacity (MW) cumulatively installed in California from 1994 to 2010.

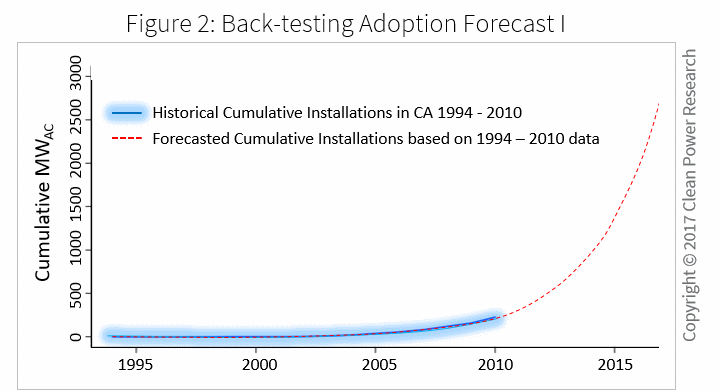

We fitted a Bass Diffusion Model to this historical cumulative installation data with the assumption that 50 GW of PV represents 100% market saturation in California. This allowed us to forecast PV adoption from 2010 to 2016, as shown in Figure 2.

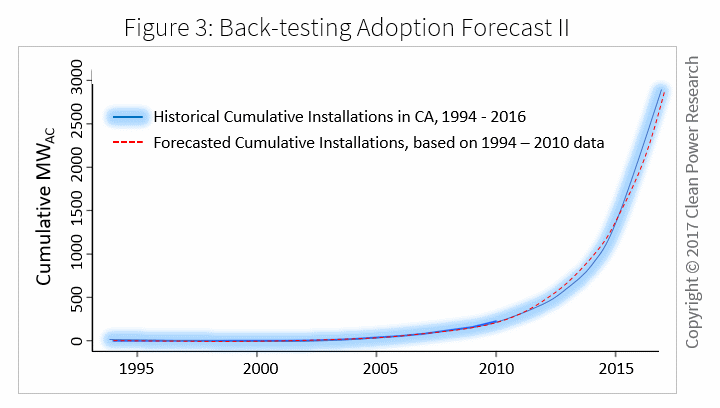

In Figure 3, we demonstrate that fitting a Bass Diffusion Model to the historical data (1994-2010) yields a reasonably accurate adoption forecast for the subsequent years from 2010-2016. This is an especially good fit given that it does not consider changes in installation costs, PV incentives or specific utility rates.

Problem solved? Well, no.

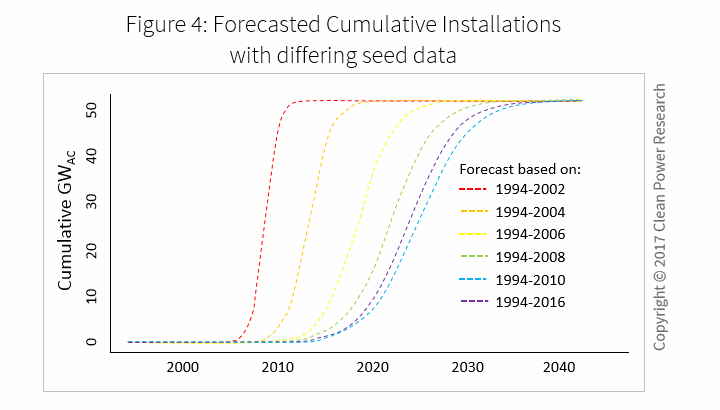

Let’s say that a utility with a nascent solar market wanted to apply this approach to adoption in their service territory. To understand how this might work, we applied the same analysis but limited the data used for fitting the Bass Diffusion Model to different time periods:

- 1994 to 2002

- 1994 to 2004

- 1994 to 2006

- 1994 to 2008

- 1994 to 2010

- 1994 to 2016

This allowed us to see what the adoption modeling would look like had we performed this analysis in 2002, 2004, 2006, 2008, 2010 and 2016, respectively.

As shown in Figure 4, the state of the market has a significant effect upon predicted adoption. Specifically, predictions based upon adoption data from early markets yield a significant overprediction of PV adoption. Note also that as the market becomes more developed, the adoption curves appear to converge. What this tells us is that this type of adoption analysis becomes more robust (as the market develops).

Understanding these effects is what makes it challenging (and also fun) to answer the DER planning questions our utility partners are most interested in. It’s also of critical importance to help utilities accurately plan for the effects of PV adoption on utility revenues, distribution grid operations and distribution grid planning.

To incorporate the effects of early markets (as shown above) along with the effects of decreasing installation costs, evolving utility rates and specific customer sub-groups into your utility’s DER adoption planning, feel free to contact us at consulting@cleanpower.com.