At the recent DistribuTECH Conference in San Diego, more than 13,000 attendees spent three engaging days discussing the biggest issues facing utilities today. One of the hottest topics, judging by session attendance and exhibit floor conversations, was Distributed Energy Resource (DER) forecasting and management.

DERs are disrupting the utility business model

In the conference keynote, Scott Drury, President of San Diego Gas & Electric, noted that his utility now gets 40 percent of its energy from renewable sources. Audrey Zibelman, Chair of New York State Public Service Commission, then reinforced the real-time aspect of the business when she said,

“When we talk about the future grid, we’re talking about moving from hours to milliseconds—where we have a dynamic read on demand, and a dynamic operating capability to meet that demand.”

DERs as non-wires alternatives

The “DER, DR and Other Non-Wires Alternatives” session track featured additional speakers from California and New York who cautioned utilities across the country that they, too, would soon face these issues. In a session on Distributed Resource Plans, one chief engineer from a west coast utility said, “If you think you won’t have to do this in the next 3-5 years, you are wrong.”

This session also highlighted that utilities are starting to recognize the value of DER, Demand Response (DR), storage and other programs as “Non-Wires Alternatives.” Utilities and regulators are now considering these Non-Wires Alternatives to replace or defer traditional transmission and distribution investments.

Notable examples of this included Southern California Edison’s Distribution Energy Storage Integration (DESI) project, SDG&E’s Ortega Highway project and National Grid’s Nantucket Island Project.

Enhanced DER tools hitting the market

DER planning and management tools were also a hot topic on the exhibition floor. Global leaders such as Siemens and GE promoted new Distributed Energy Resource Management Systems (DERMS). Smaller vendors like Smarter Grid Solutions (SGS) also demonstrated targeted solutions. And established vendors like Eaton Cyme showed new functionality to enable better DER planning.

One recurring theme at the Clean Power Research booth was whether utilities have the level of detail needed on behind-the-meter DER to plan and manage the impact of these systems. Many utilities still manage interconnection applications with manual processes or siloed applications. Not only do these processes slow application processing, they limit access to accurate data for use downstream.

An integrated interconnection workflow for DERs

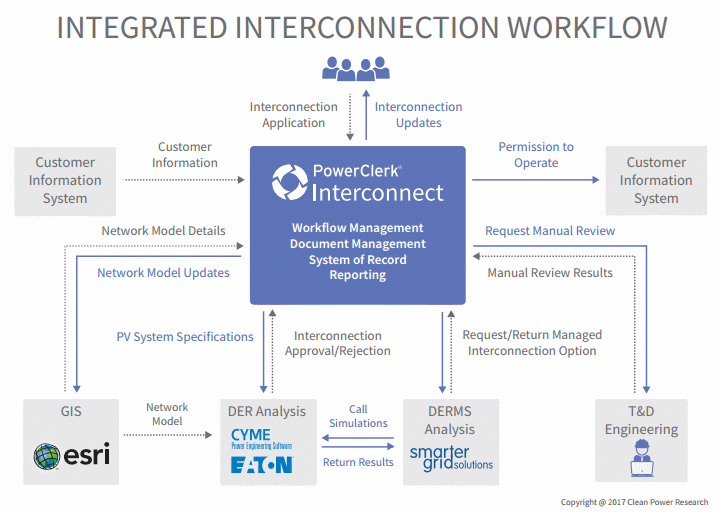

To address the challenges of DER planning, Clean Power Research partnered with Eaton Cyme and Smarter Grid Solutions to release a new whitepaper that shows how a utility can use PowerClerk® as the application hub to create an integrated interconnection process.

In this example, using PowerClerk along with their existing GIS (/products/powerclerk/ArcGIS from Esri), power system analysis software (CYMDIST from Eaton Cyme) and Active Network Management software (from SGS), a utility can start to solve many of the DER planning challenges discussed at DistribuTECH.

Forecasting DERs

Another key component of integrating DERs will be circuit and sub-circuit level forecasts and ‘nowcasts’ for distributed PV. A major CA IOU described how their system operators had become ‘gun-shy’ when switching circuits with significant PV penetration during daytime hours since the operators lacked sufficient visibility into PV production. With the help from products such as SolarAnywhere®, this type of information is now readily available.

Similarly, during conversations on the trade-floor, DERMS, microgrid and storage solution providers all indicated interest in PV forecasts, which was not on their product roadmaps a year ago.

Where will DERs be next year?

Perhaps the most remarkable takeaway from this year’s DistribuTECH was something quite subtle. Despite the change in administration at the federal-level and the resulting potential for significant change to the Clean Power Plan and U.S. energy policy, there was little talk of how this would impact DERs.

We suspect that this is because the value proposition of DERs is strong enough for all stakeholders (utilities, DER customers, non-DER customers and regulators) that DERs are here to stay.

For more information on integrating DER solutions using PowerClerk, download the whitepaper, “Resolving the Conflict Between Distribution Planning and Interconnection Processes.”