You can’t go anywhere these days without hearing about the price of oil. While in past years that often meant oil prices were skyrocketing, today, oil is threatening to hit 20-year lows (in inflation adjusted dollars). Right now, oil demand is so low, and supply is so high, that some commentators are worried the world will run out of storage.

And these price drops aren’t just hitting oil. Most major energy sources are at or near record-low prices, including coal, natural gas and solar panels. In fact, solar panels have seen prices go down by 99% over the past 40 years.

Is this the beginning of a new golden age of low energy prices? As the energy industry transforms, we should expect to see new technologies and varied fuel sources shift how we generate, distribute and use energy—all of which will continue to enhance energy price competition.

Lower for longer, or lower forever?

The catch phrase in the oil patch these days is “lower for longer.” Longer could mean 15 years like it did after the oil price crash that began in December of 1985. But what if it isn’t lower for longer, but lower forever? What if this trend isn’t just applicable to oil, but to all forms of energy?

2016: Energy price competition heats-up

Oil, coal and gas prices are typically highly volatile and go through “commodity super cycles” that are characterized by great price boom and bust cycles. Beginning with rapid price increases, followed by excessive investment in extraction, these super cycles end with rapid price drops as excessive supply hits the market.

Historically, volatility has been caused, in part, by the long timelines required to develop new extraction assets such as mines, oil wells, etc., as well as new technologies that enable economical access to previously inaccessible resources, and/or improved fuel yields from extracted resources. This dynamic is changing, however, with the addition of solar and wind in the energy mix.

Distributed, renewable resources—which can be rapidly deployed and are not subject to the same commodity super cycles—are now broadly competitive with fossil fuels, increasing competition within the energy sector. Even though these resources are intermittent, their predictability and reliability over the long term are likely to contribute to lower energy price volatility, and lead to lower energy prices.

Fuel switching: Driving new price competition

Traditionally, petroleum fuels have been the main source of energy for transportation. While oil could compete in electrical generation and home heating (albeit not very effectively), natural gas has competed with oil as a transportation fuel only on a very limited basis. Electric vehicles are changing that dynamic.

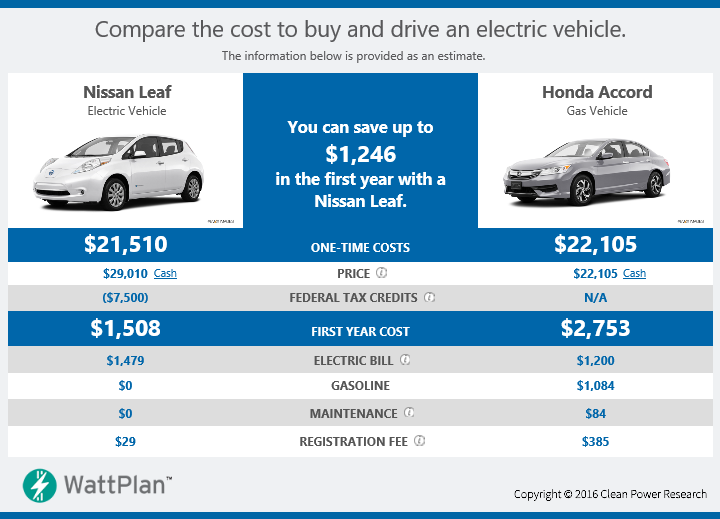

Electric vehicles allow coal, natural gas, wind and solar to compete as transportation fuels, often at dramatically lower cost than traditional gas-powered vehicles.

Utilities, plagued by stagnant or declining load growth, are getting a lot more entrepreneurial and starting to encourage energy efficiency options that increase load through fuel switching—the use of new technology that foregoes a traditional fuel source like natural gas in favor electricity—even as they reduce costs for their customers. Examples of such technologies include electric vehicles, heat-pump space heaters and heat-pump water heaters.

Watch for utilities to compete aggressively with the oil industry for transportation fuel dollars in 2016.

Software: The secret to success

With energy price competition heating up, utilities and the solar industry will need to drive down their costs. Software is the secret weapon that has been instrumental in increasing efficiency and driving down costs in many other industries. Within the energy industry, software is making it possible to do things such as predict volatility in renewable fuel sources, efficiently switch between energy sources, incorporate demand response strategies and much more—all critical functions to ensuring reliability and cost-competitiveness over the long-term.

At Clean Power Research, we’re already busy helping our customers compete in the new energy environment. Whether it’s driving down administrative costs with PowerClerk®, grid integration and O&M costs with SolarAnywhere®, or customer acquisition and support costs with WattPlan®, we’ll be there to help our customers thrive and win.